Pureprofile (ASX:PPL, or “the Company”) is pleased to release its final Appendix 4C and June Quarterly Activity Report. The Company is reporting another record quarter of revenue in Q4 of $16.2m and continued growth across each of its business units over the previous corresponding period (PcP).

Highlights

- Q4 revenue of $16.2m – a record quarter for Pureprofile

- Unaudited pro forma FY17 revenue of $63.2m (statutory $52.9m)

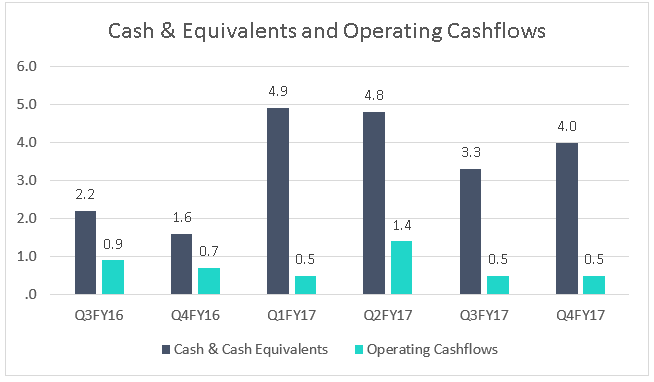

- Q4 operating cash flow of $0.5m

- Cash and cash equivalents of $4.0m at the end of June 2017

- H2 FY17 statutory and pro forma operating EBITDA margins will exceed H1 FY17 EBITDA margins

Appendix 4C

Pureprofile continued to record positive operating cash flows for the quarter of $0.5m and $2.9m for the full FY17 year. This represents Pureprofile’s sixth consecutive quarter of positive operating cash flow with cash receipts for the quarter reaching $15.2m.

The Company expects continued positive and increasing operating cash flow in FY18.

Cash and cash equivalents as at June 30 2017 was $4.0m representing an increase in cash and cash equivalents of $2.4m compared to June 30, 2016.

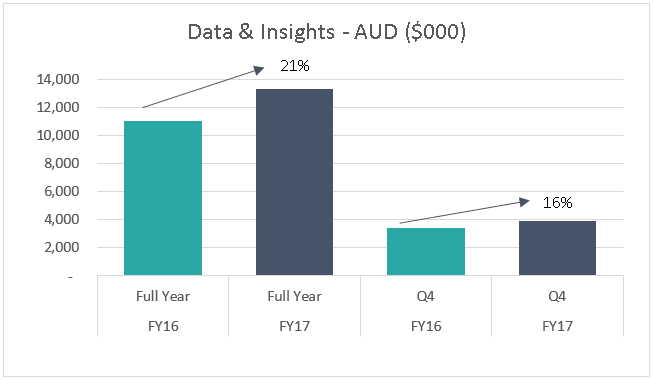

Data and Insights – FY17 revenue growth of 21%

The Data and Insights business unit continued to perform well, recording $3.9m revenue for the quarter and $13.3m for the year, an increase for the quarter of 16% on Q4 FY2016 and an annual revenue growth rate of 21%.

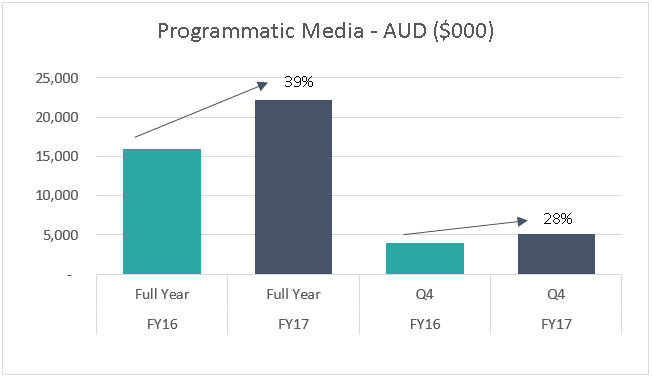

Programmatic Media – FY17 pro forma(1) revenue growth of 39%

The Programmatic Media business unit continued to grow strongly, with revenue reaching $5.1m for the quarter and $22.1m for the year, a pro forma increase for the quarter of 28% on Q4 FY2016 and an annual pro forma revenue growth rate of 39% on FY16.

(1) FY2016 includes pro forma revenue 1 July 2015 to 24 July 2015.

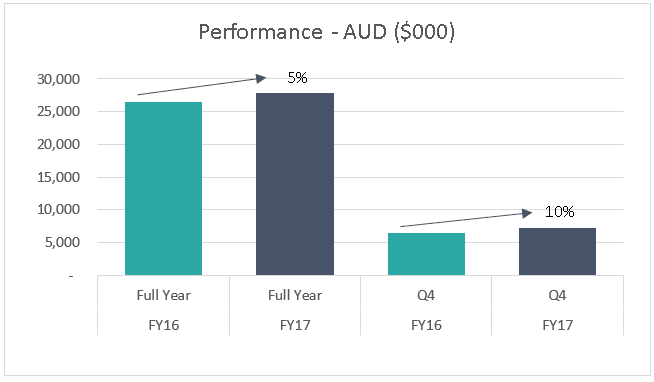

Performance – FY17 pro forma(2) revenue growth of 5%

The Performance business unit experienced slower growth with revenue of $7.1m for the quarter and $27.8m pro forma for the year, a pro forma increase for the quarter of 10% on Q4 FY2016 and an annual pro forma revenue growth rate of 5% on FY16.

The Performance business unit’s UK business continued to grow well with annual pro forma revenue increasing by 41% over the last year. Australia also returned to growth in Q4 as anticipated.

(2) FY2016 includes pro forma 1 July 2015 to 30 June 2016 and FY2017 includes pro forma 1 July 2016 to 8 November 2017.

Cohort Acquisition Update

In Pureprofile’s half-year accounts a provision of $8.5m was made for deferred consideration relating to the earn-out. It is anticipated that any cash component of the earn-out will be funded from cash and working capital. The earn-out accounts are subject to finalisation in August.

There are two tranches to the earn-out consideration. If earned, both would be payable in Q2FY2018:

- Earn-out Tranche 1 – earned if FY17 normalised EBITDA is $4m or more. Consideration is payable in Pureprofile shares to be issued at $0.45 per share and escrowed until May 2018; and

- Earn-out Tranche 2 – the relevant calculation is expected to be 5x (FY17 normalised EBITDA less $4m). Consideration would be payable in either cash or PPL shares (issued at a minimum price of $0.50) with the form of consideration at the seller’s discretion.

Annual Financial Statements and Appendix 4E

Pureprofile anticipates releasing its Annual Financial Statements and investor update in late August 2017. The update will provide more detailed information on the performance of the Group and outlook.

-ENDS-