By: Shelley Barber, Senior Business Development Director

In recent years, the UK housing market has seen significant shifts, from rising property prices to changing expectations around how people buy, sell, and invest. Today, affordability challenges are top of mind: in our latest survey, UK adults identified high mortgage or rental costs (29%), a lack of affordable or social housing (25%), and high sales taxes and fees (16%) as the biggest obstacles in the current market. On average, UK residents spend 35% of their income on a mortgage or paying their rent, rising to 41% among Gen Zs.

Using Pureprofile’s all-in-one research platform, Datarubico Insight Creator, we set out to understand what the future of housing looks like through the eyes of UK residents: what they’re prioritising, what concerns they have, and how their financial goals are evolving.

We surveyed 500 UK adults to explore views on homeownership, affordability, renovation plans, and the growing influence of technology in the property journey. The findings offer a snapshot of how people are planning for the future and where the market may be headed next.

Homeownership is seen as key to financial success, especially among the young

Despite soaring housing costs, homeownership remains a key financial aspiration in the UK. Our study found that 77% of UK adults see it as essential to achieving financial success – a sentiment especially strong among younger generations, with 89% of Gen Z and 81% of Millennials in agreement.

This ambition persists despite the growing affordability gap, as UK house prices have outpaced wages by more than double over the past two decades, making the dream of owning a home increasingly challenging but no less valued.

Home improvements, mortgage payoffs, and first homes top UK housing goals

When asked about their financial priorities related to housing or property in the next five years, UK adults identified these three areas as their top priorities: renovating their current home to increase its value (13%), paying off their mortgage faster (11%), and saving for a deposit to buy their first home (11%).

Even among mortgage-free homeowners, 1 in 5 still plan to renovate to boost property value. This focus on property enhancement aligns with recent government data indicating that, as of April 2025, the average UK house price increased by 3.5% year-on-year.

Such trends underscore the enduring perception of property as a stable and appreciating asset, motivating homeowners to invest in their properties to capitalise on long-term value growth.

Balancing technology and human touch in UK home buying

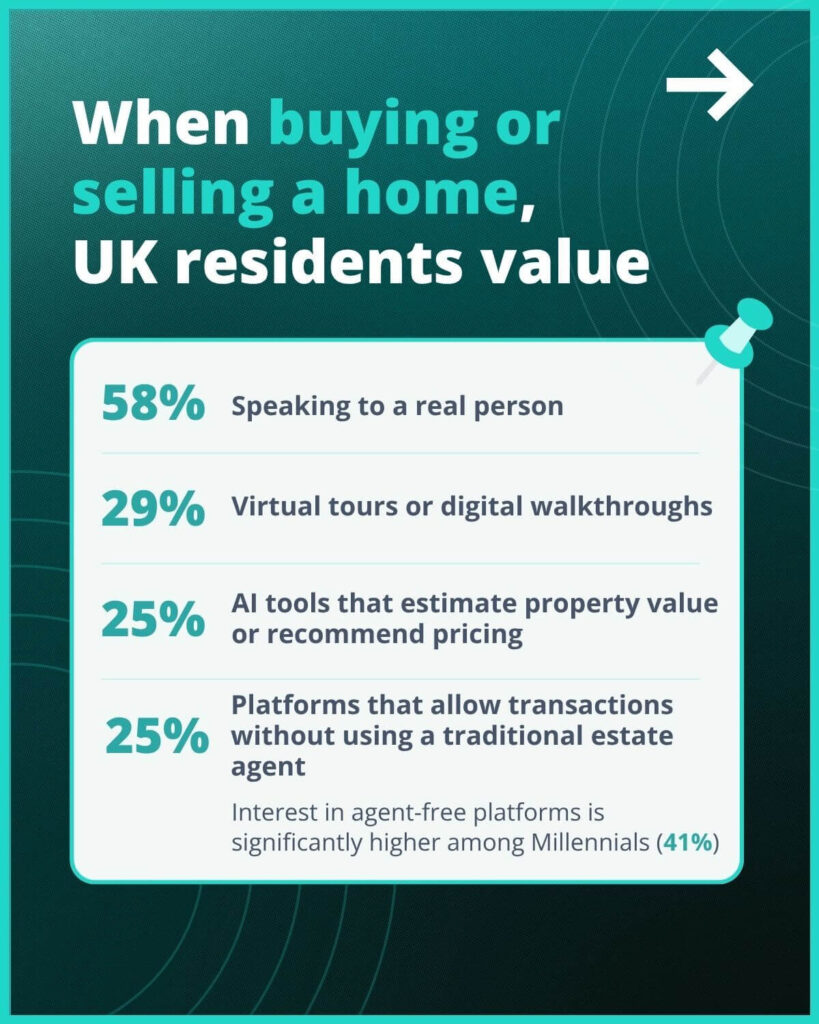

When it comes to buying or selling a home, UK adults are seeking a balance between personal reassurance and digital convenience, because for many it’s not just a financial transaction – it’s one of life’s biggest decisions. In our survey, 58% said they want to speak to a real person when navigating the process, showing that human connection still matters deeply in moments of change.

But there’s also clear demand for tech-enabled tools: 29% value virtual tours and digital walkthroughs, while a quarter are open to AI tools that help estimate property value or suggest pricing. Another 25% say they’d consider using platforms that skip the traditional estate agent entirely. Interestingly, millennials are leading this shift – 41% prefer agent-free platforms, signalling a generational rethink of how we buy and sell homes.

This shift aligns with the UK government’s 2025 initiative to digitise the homebuying process, aiming to make transactions quicker, cheaper, and less stressful. The plan includes digitising key property data, introducing digital identity verification, and establishing common data standards across the sector.

The infographic below represents key findings from our research:

Based on a nationally representative study of N=500 UK residents (ages 18+), conducted on Datarubico – Pureprofile’s all-in-one research platform, from 14–25 June 2025.

Share this infographic on your website

Shelley Barber

Senior Business Development Director

With over 22 years of experience in sales across finance, media, and recruitment, and 9 years specialising in market research, Shelley brings a uniquely strategic and client-focused approach to business growth. Currently a Senior Business Development Director, she leverages deep industry knowledge and a track record of success to build meaningful partnerships, drive revenue, and uncover insights that inform smarter business decisions.

Shelley has a proven ability to identify emerging market opportunities, craft compelling value propositions, and lead cross-functional teams to exceed commercial targets. Drawing on a strong foundation in sales and a data-driven mindset honed through years in research, she bridges the gap between customer needs and business solutions with clarity and precision.

Known for her consultative approach and collaborative style, Shelley continues to be a trusted advisor to clients and colleagues alike, committed to long-term value creation and sustainable growth.