Pureprofile Limited (ASX: PPL) (“Pureprofile”, “PPL” or “the Company”) is pleased to announce it has entered into a binding agreement to acquire 100% ownership of Cohort, a leading digital marketing group that provides lead generation solutions in Australia, the UK and the US (“Proposed Acquisition”).

Key Highlights:

- Binding agreement signed to acquire 100% ownership of Cohort Holdings Australia Pty Ltd (“Cohort”)

- Cohort is a market leader in providing innovative lead generation solutions for advertisers and publishers in Australia, the UK and the US

- Highly complementary to Pureprofile’s operations and delivers increased scale domestically and internationally

- Cohort generates growing revenues and earnings – FY16 revenue was $27.3m and EBITDA was $3.7m

- Substantial increase in scale and stronger financial performance – in FY16, Pureprofile and Cohort combined generated $55.8m of pro forma revenue and $6.3m of pro forma operating EBITDA

- Acquisition is expected to be EPS accretive in the first year

- Cohort’s team of 47 staff will continue to be led by its co-founders

- PPL to pay Cohort sellers upfront purchase price of $15m cash and $3m of Pureprofile shares, plus conditional two-tranche earn-out based on Cohort’s FY17 EBITDA

- Upfront purchase price and additional growth capital to be funded by an oversubscribed share placement of $14m, a new $7.5m debt facility with CBA and a share purchase plan of $3m to be fully underwritten

Pureprofile Limited (ASX: PPL) (“Pureprofile”, “PPL” or “the Company”) is pleased to announce it has entered into a binding agreement to acquire 100% ownership of Cohort, a leading digital marketing group that provides lead generation solutions in Australia, the UK and the US (“Proposed Acquisition”).

Cohort is a natural extension to Pureprofile’s business. Expected benefits from the combined group include:

- Enhanced service offering – Cohort’s lead generation and marketing services are highly complementary to Pureprofile, and will benefit from Pureprofile’s data insights and programmatic media capabilities

- Cross-sell and up-sell opportunities – to new and existing customers of both businesses

- Strengthens competitive position – both businesses have aligned client categories across the same regions. They include advertisers, publishers, media owners and market researchers

- Accelerates growth in UK and US – increases scale and opportunities for Pureprofile and Cohort in their fastest growing international markets

Cohort Business Overview

Cohort is a leading digital marketing business, which provides lead generation solutions. Founded in 2008 by the current CEO and COO, Cohort employs 47 staff in Sydney, London and New York.

Cohort’s clients are synergistic with Pureprofile’s and include advertisers, media owners, publishers and market researchers in Australia, the UK and the US. The business invoices approximately 160 clients per month, being a mix of large corporate and e-commerce businesses. The majority of Cohort’s largest clients have tenure with Cohort exceeding four years.

Cohort provides its clients with high-quality leads from registered consumers. It has over 2.5 million registered consumers who have entered competitions and opted-in to surveys providing their details and ongoing consent to be contacted by Cohort and selected clients. Each month, approximately 150,000 new consumers register with Cohort, and its clients purchase approximately 650,000 new leads per month.

Cohort also provides email marketing, database acceleration and audience monetisation solutions.

Cohort’s competitive advantages include its market position, reputation, scale, geographic reach and proprietary technology ensuring leads sold are consistently of a high quality.

Cohort has delivered impressive growth with revenues increasing organically from $11 million in FY14 to over $27 million in FY16. In FY16, Cohort’s EBITDA grew to $3.7 million.

Post-acquisition, Cohort’s co-founders, Marcelo Ulvert (CEO) and Malcolm Treanor (COO) intend to remain in their current roles and, as part of Pureprofile’s senior leadership team, will be responsible for continuing Cohort’s growth and its expansion in the UK and US markets.

Pureprofile and Cohort

Pureprofile’s and Cohort’s businesses are highly aligned in relation to target clients, creating an opportunity for ‘hyper growth’ both domestically and internationally. The diagram below illustrates how Cohort fits into Pureprofile’s existing businesses.

Both Pureprofile and Cohort are consumer-focused and serve the same types of customers. Cohort’s registered consumers and clients will benefit from Pureprofile’s profiling, data insights and programmatic media expertise and technologies. Pureprofile will benefit from Cohort’s expertise in attracting and engaging with consumers and generating and selling high-quality leads and digital marketing solutions.

Pureprofile believes that, in time, there will be substantial product and revenue synergies, along with efficiencies from combining and strengthening the technology development teams.

Cohort will retain its brand and management team following completion of the Proposed Acquisition, and will continue to operate in its current form utilising Pureprofile’s resources and capabilities to further strengthen its business.

Transaction Overview

Pureprofile has agreed to acquire 100% of the shares in the holding company of the Cohort Group. Subject to various conditions being satisfied prior to completion of the Proposed Acquisition (“Completion”) completion is targeted for early November 2016.

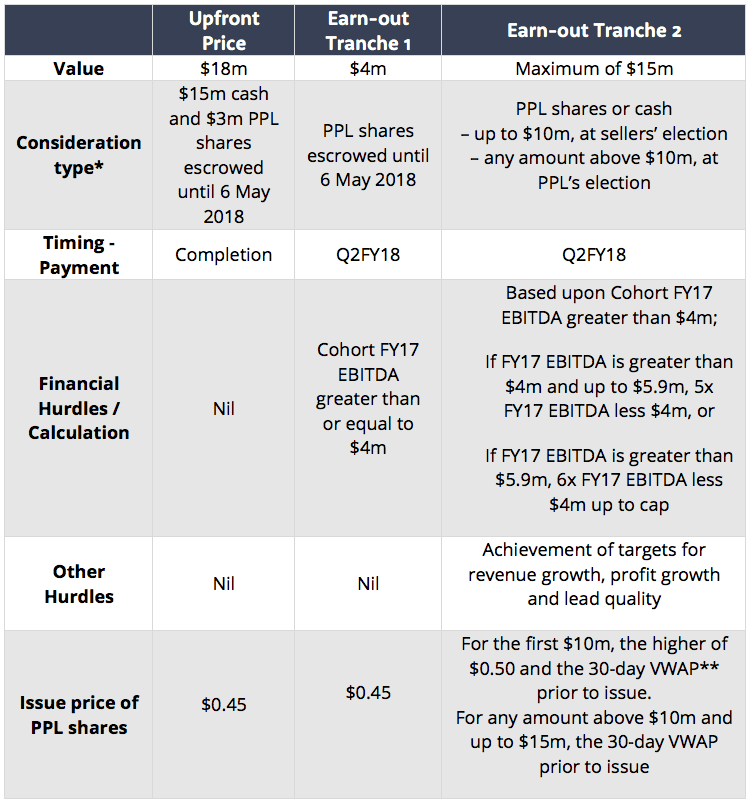

The purchase price for Cohort comprises $15 million in cash and $3 million in Pureprofile shares payable/issuable on Completion (subject to adjustment for Cohort net debt and working capital as at Completion), plus a conditional two-tranche earn-out based upon Cohort’s FY17 EBITDA (to 30 June 2017) and the achievement of certain growth and lead-quality targets. The components of the purchase price (including the earn-out conditions) are summarised below:

* The issue of PPL shares is subject to the receipt of all requisite shareholders approvals under the ASX Listing Rules.

** Volume Weighted Average Price

Funding and New Debt Facility

To fund both the Cohort acquisition, and an expected increase in the combined group’s future working capital requirements, Pureprofile is undertaking the following funding initiatives:

Placement – $14 million

Pureprofile has received irrevocable commitments to subscribe for $14 million of new PPL shares, via a share placement to institutional and sophisticated investors at $0.45 per share (“Placement Offer Price”):

- The Placement Offer Price represents a discount of approximately: (i) 13.5% to the last closing price of PPL shares prior to the date of this announcement (on 19 September 2016) of $0.52 per PPL share; and (ii) 15.6% to the VWAP of PPL shares over the 15 trading days up to and including 19 September 2016 of $0.533 per PPL share.

- Blue Ocean Equities was the sole Lead Manager and Bookrunner of the Placement and Shaw & Partners acted as the Co-manager to the transaction.

- Pureprofile was advised on the acquisition of Cohort and the capital raising by corporate advisors, TMT Partners and Addisons Lawyers.

Share Purchase Plan – $3 million

The Pureprofile Board is proposing to undertake a $3 million share purchase plan (“SPP”) to be fully underwritten by Blue Ocean Equities:

- Full details regarding the SPP will be provided to existing shareholders as at 21 September 2016 in the SPP Offer Booklet and Application Form, to be released on ASX and dispatched to eligible shareholders later today.

Debt Facility – $7.5 million

Pureprofile has received credit approval from the Commonwealth Bank of Australia in respect of a new debt facility of up to $7.5m, of which $4m may be applied for the purposes of the Proposed Acquisition and up to $3m as an overdraft and a further $0.5m in respect of a bank guarantee.

Further information regarding these funding initiatives and the proposed use of funds can be found in the investor presentation entitled “Acquisition of Cohort and Capital Raising”.

Management Commentary

Pureprofile’s Managing Director and CEO, Paul Chan, commented:

“This transaction marks a major step in Pureprofile’s growth and is in line with our previously stated goal of acquiring businesses that complement existing operations, deliver scale, and make an immediate contribution to revenue and earnings. Cohort fits all of these criteria, as well as giving Pureprofile a much greater competitive advantage in the areas of lead generation, digital marketing, programmatic media and data insights.

“After completion of the acquisition, Pureprofile will significantly extend its client and publisher relationships, a database of 3.5 million registered consumer profiles that is growing monthly, operations across Australia, New Zealand, the United States, the United Kingdom, and Europe, and a business with an enhanced service offering to drive growth. The cross-selling and up-selling opportunities are compelling. We are also pleased to welcome Cohort’s team to Pureprofile and are confident that will continue to drive the business’ growth as part of Pureprofile.

“The combination of Pureprofile and Cohort establishes a very solid organic growth platform for FY17 and beyond, and we are intent on capitalising on this by delivering superior outcomes for our respective clients. This will in turn deliver greater value for our shareholders.”

Cohort Group’s Co-Founder and CEO, Mr Marcelo Ulvert, added:

“As a shareholding group, we are delighted with this transaction as it fully aligns to our vision of accelerated growth for Cohort through globalisation, improved technology platforms and obvious synergies that benefit the group. This is most clear in our enhanced ability to ensure maximum reach and capability delivering superior client and consumer experience and further business growth. We are fully committed to the next phase of this journey and look forward to cementing a position as market leaders both here in Australia and internationally.”

-ENDS-