Pureprofile Limited (ASX: PPL or the Company) announces its financial results for the financial year ended 30 June 2018.

Revenue

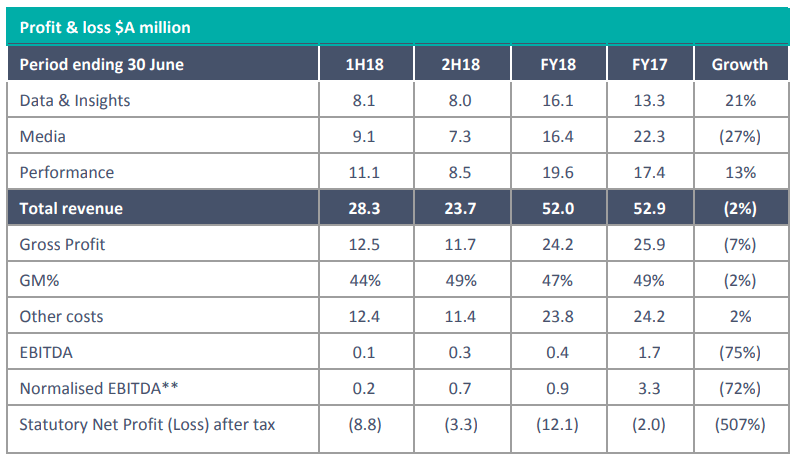

Total revenue for FY2018 was down by 2% compared to FY2017*. Second half performance was impacted by:

- Prioritising the cost restructuring program which has eliminated approximately $5m of annualised costs and resulted in an on-going annualised cost base of around $20-$21m for FY2019.

- Management’s strategy to shifted focus away from sales of low-margin/highly-commoditised services to higher margin services within the Media and Performance business units.

- New appointments to board of directors: Sue Klose NED and Marcelo Ulvert NED. Executive Chairman moved to Non-Executive Chairman focussed on maximinsing board value creation and investor communications.

- New Executive Leadership team in place with three of the five senior appointments focused on generating revenue. CEO excelling: attracting top talent, delivering results and driving revenue initiatives.

- Integrated siloed business units into one consolidated platform under the Pureprofile brand, coinciding with a refreshed look and feel and simplified messaging.

- New streamlined finance structure with more efficient process and procedure under new CFO.

- Internal overhaul of internal communications practices focussed on cultivating a best-in-class business culture to support retention and recruitment of high-calibre talent.

*FY2017 revenue includes the contribution from the Cohort acquisition for approximately eight months.

Margin and EBITDA

The average Gross Margin for FY2018 was 47%, down from 49% in FY2017. However H2FY2018 performance improved strongly on H1FY2018 (H2FY2018: 49%; H1FY2018: 44%). The increase in Gross Margin % in the second half reflects management’s increased focus on selling higher margin services where Pureprofile has stronger competitive advantages.

Normalised EBITDA for FY2018 was $0.9m, down from $3.3m for FY2017. Encouragingly, normalised EBITDA was increasingly positive for each of the four months and exceeded $1.4m, with June normalised EBITDA of $545k.

FY2019 – Revenue and Margin Focus

In FY2019, Pureprofile’s management team will continue to focus on cost control with the recent appointment of its new CFO. Further margin improvements are expected to be realised through targeted revenue growth, enhanced by the appointments of the Company’s new Head of Revenue and Operations (ANZ) and Managing Director UK/EU in revenue-focused roles driving growth and profitability.

Pureprofile CEO and Managing Director, Nic Jones, said: “Stabilising the cost base at around $20-21 million and finding approximately $5 million in savings was a key challenge in the second half of FY2018. This took greater time and focus than initially contemplated, particularly without a CFO for much of the year. Focusing on the cost base has been the priority to ensure that the business remains sustainable and our revenues have a greater impact on our bottom line in the long term.

“Having set these foundations, and with a CFO to monitor and maintain the cost base, we are again strongly positioned to focus on growing revenues and improving margins. These are key areas that I will be focused on in FY2019, supported by the recent appointments of our Head of Revenue and Operations (ANZ) and Managing Director UK/EU.”

– ENDS –