Pureprofile Ltd (ASX:PPL) on track to exceed full year revenue forecasts with 62% organic growth in first half year.

-

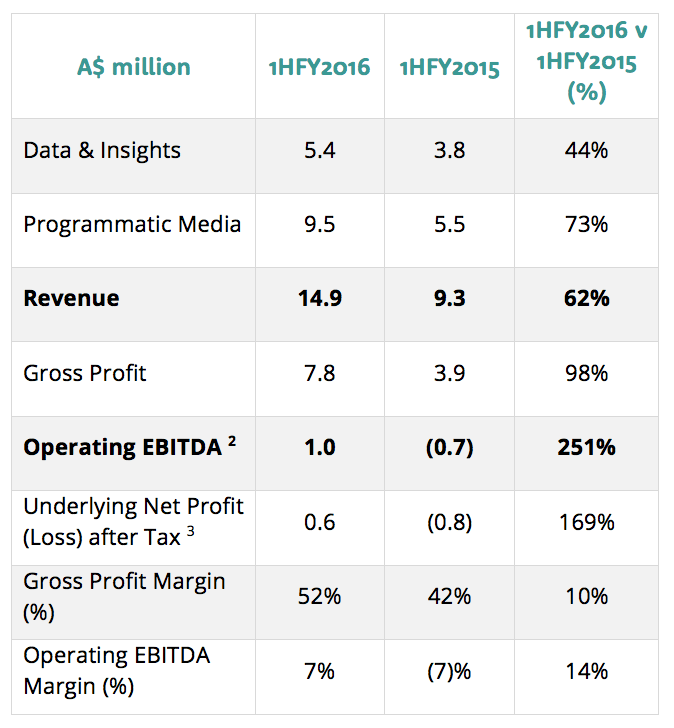

1H FY2016 revenue of $14.9 million – up 62% on previous corresponding period

-

1H FY2016 operating EBITDA of $1.0 million – a 251% increase

-

Sparc Media integrated and performing well under PPL’s ownership

-

Two key divisions established – Data & Insights, and Programmatic Media

-

Full-year revenue expected to exceed prospectus forecasts of $28.1 million

-

Well placed for continued organic growth and acquisition opportunities being pursued

Big data technology and programmatic media company Pureprofile Limited (ASX: PPL or the Company) is pleased to report strong revenue and earnings growth for the half-year ended 31 December 2015. The financial results are on a pro forma basis and include a six-month contribution from the Sparc Media business.

Financial Performance (1)

Revenue for the FY16 first-half increased 62% to $14.9 million (H1 FY2015: $9.3 million) and operating earnings before interest, tax, depreciation and amortisation (operating EBITDA) was $1.0 million, a significant improvement on the $0.7m loss in 1H FY15.

Pureprofile is pleased that the majority of revenue growth was organic across both the Data & Insights and Programmatic Media divisions. Early indications in 2H FY16 are that organic revenue growth will continue at a similar rate with full-year revenue likely to exceed the prospectus forecast of $28.1 million.

Notes:

1. The financial information is provided on a pro forma basis and has been derived from the reviewed financial accounts of Pureprofile Limited and Sparc (comprised of Sparc Media Pty Ltd, Adsparc Pty Ltd, Future Students Pty Ltd, Funbox India Private Ltd and Sparc Media sp. z.o.o.).

2. Operating EBITDA excludes interest, tax, depreciation, amortisation, and one-off non-recurring transaction costs associated with the IPO, Sparc Media acquisition, and one-off non-operational costs.

3. Underlying Net Profit (Loss) after Tax excludes one-off non-recurring transaction costs associated with the IPO and Sparc Media acquisition.

Operational overview – 1H FY16

Pureprofile completed the integration of the Sparc Media business, which is now performing strongly as part of the Company.

Sparc Media has been a key catalyst for Pureprofile to form two well-defined operating divisions (Data & Insights, and Programmatic Media) and build scale into both. Dedicated management has been appointed to grow and develop both businesses with Pureprofile now able to offer clients more targeted and effective digital marketing campaigns that deliver a competitive advantage through programmatic media.

Pureprofile continued to strengthen its alliance with News Corp Australia, adding further value to the Company’s SaaS platform, which is used for profiling and big data insights. This allows Pureprofile to target other top-tier publishers internationally with a strong and market-leading value proposition.

Pureprofile also established a New Zealand presence in the second quarter with the incorporation of Pureprofile NZ Limited. Establishing a local presence in New Zealand, and the ongoing partnership with AA Smartfuel positions Pureprofile well to build a substantial business in New Zealand.

Management commentary

Pureprofile’s Chief Executive Officer, Paul Chan, said:

“First-half performance has been very encouraging and demonstrates the strong growth characteristics that our operating businesses possess. Most notable is the fact that the majority of revenue growth has been organic, which reflects the high demand for data and analytics, and the increasing take up of programmatic media trading.”

“We have continued to invest in our SaaS platform with a number of new features added. This ensures we maintain a market-leading position as witnessed by the new business wins we have secured. Our pipeline of new tenders is growing encouragingly.”

“Our first half as a listed company has positioned Pureprofile for growth. We have a strong executive team in place, a well-defined growth strategy, and excellent operating divisions with solid growth prospects. Our priority is to deliver on revenue and earnings targets for the second half while at the same time pursuing growth opportunities that strengthen our underlying operations and financial performance. Both acquisitions and organic growth opportunities are constantly evaluated.”

Outlook

The second half has started strongly with both divisions trading well. Expansion into the United States programmatic media market will continue this half with our focus on publisher relationships under our AdSparc brand.

As reported on 23 February 2016, the acquisition of the Effective Measure assets present Pureprofile with another growth platform from relationships with over 60 publishers across Australia and New Zealand (together representing over 100 websites). Pureprofile expects to extract meaningful organic revenue and add key platform technologies via the acquisition.

Pureprofile is on track to exceed prospectus revenue forecast. The company looks forward to updating shareholders on a number of operational developments in the near term.

-ENDS-