Pureprofile Ltd (ASX: PPL) is pleased to advise of record revenue growth and strong operating cash flow in the December quarter.

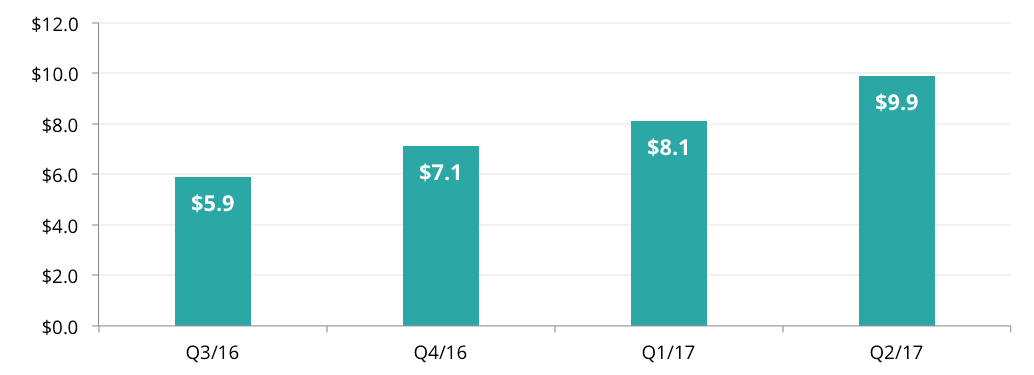

- Record revenue[1] of $9.9m up 27% over Q2/16[2]

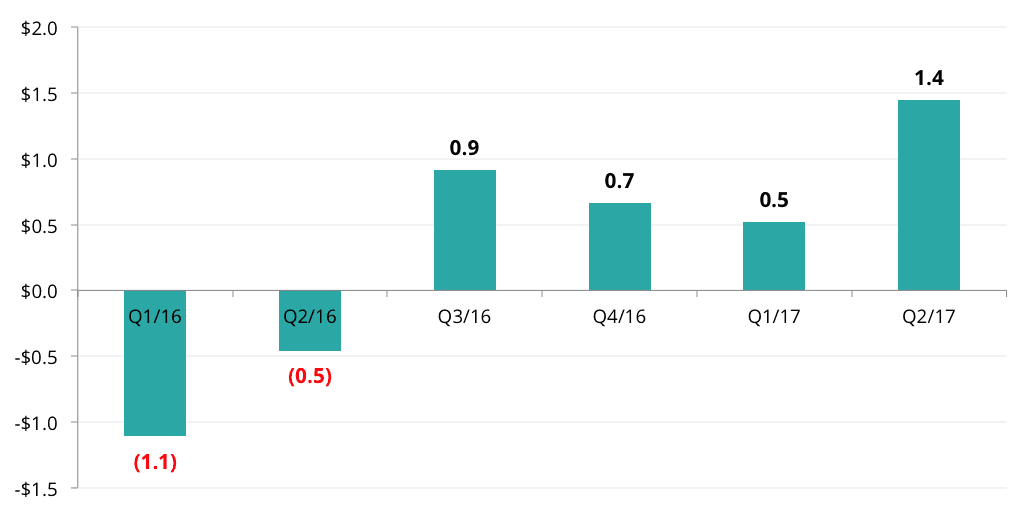

- Positive Operating cash flow quarter of $1.4m – fourth consecutive quarter of positive operating cash flow (up 2.8x from $0.5m in Q1/17)

- Cash and cash equivalents of $4.8m

- Integration of Cohort proceeding as planned, with significant revenue and profit contribution anticipated for the full year

Continued strong revenue growth

The December quarter reported underlying revenue, (excluding Cohort) of $9.9m representing a record result for the Group of 27% growth (Q2/16 $7.9m pcp).

Quarterly underlying revenue (excluding Cohort) $M 2

Four consecutive quarters of positive operating cash flow

Operating cash flow was $1.4m with cash receipts increasing to $12.6 million for the quarter. Operating cash flow has now been positive for each of the last four quarters and this trend is expected to continue in the second half of FY17.

Cash and cash equivalents at the end of December was $4.8m.

Cohort acquisition progressing strongly

The acquisition of Cohort completed on the 8th November 2016. Cohort continues to perform well and integration is proceeding as planned. We expect significant revenue and profit contribution to the Pureprofile groups full year result.

Interim Financial Statements and Reporting

Pureprofile anticipates releasing its half-year results and an investor update on Thursday 23rd February 2017. This update will contain more detailed information about the performance of and outlook for Pureprofile.

[1] Underlying Q2/17 revenue excludes Cohort Group

[2] Comparison with Q2 FY16 excludes contribution from Sparc Media India and Poland (discontinued in FY16)

-ENDS-