Key points:

- Q1 FY20 EBITDA: $0.75m

- Cost savings from management changes in Q1 will add over $0.2m to EBITDA in future quarters

- Strong growth in the UK:

- UK Data & Insights business, up 48% on pcp

- UK Performance business achieved consistent growth over the last three quarters

- Senior debt facility was increased to reduce payables and replace the IFG debtor finance facility

Pureprofile Limited (ASX: PPL or the Company) is pleased to provide an update on its Q1 FY20 performance, ending 30 September 2019.

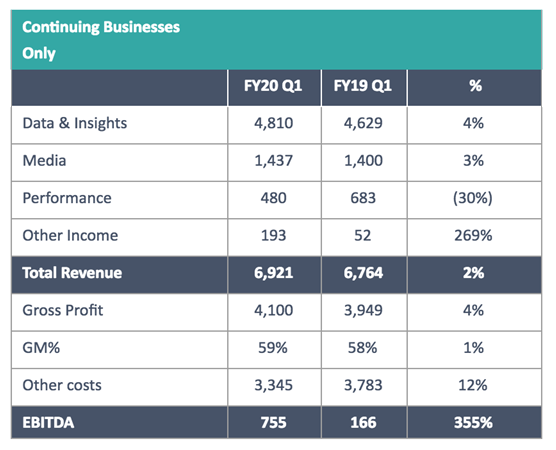

Q1 FY20 Results

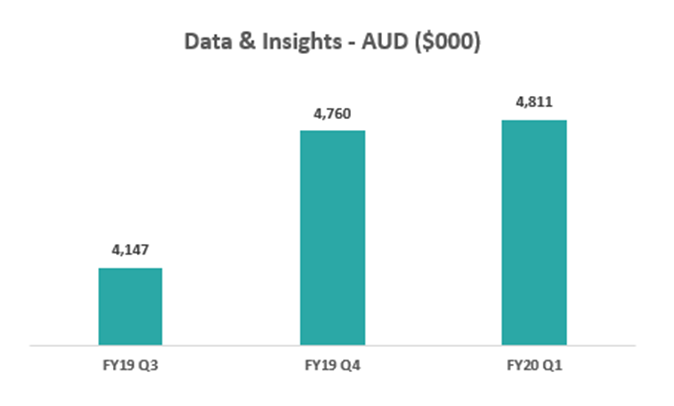

The Data & Insights business unit recorded $4.8m of revenue for the quarter, consistent with its highest quarterly revenue. This strong result was driven by the UK achieving record revenue for the quarter of $1.2m, a 48% revenue growth on prior comparable period (pcp). The ANZ and US businesses recorded revenues of $3.4m and $0.2m respectively.

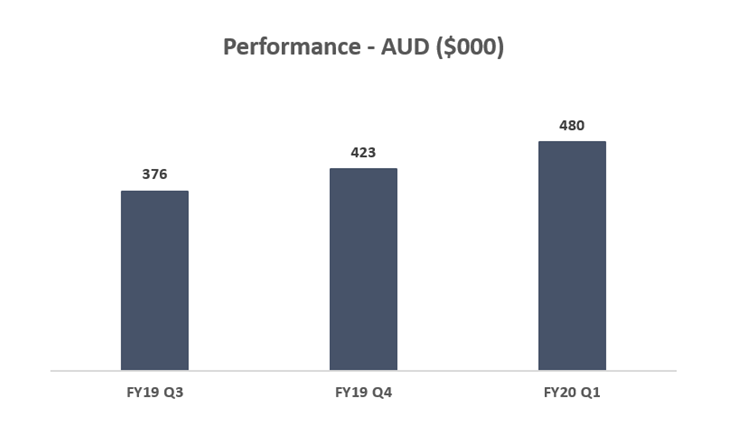

Revenue from the UK-based Performance business unit, which is focused on lead generation, was down 30% on pcp. During Q2 FY19, the Performance business was negatively impacted by the introduction of GDPR and a reduced sales capability. Since then however, the business unit has been recovering well and it has shown consistent growth over the last three quarters:

These strong results, combined with the increase in gross margin and significant reduction to costs, considerably improved EBITDA on pcp.

Further improvements to EBITDA are expected with a focus on ANZ revenue growth, which will be overseen through the recent appointment of Ms Anna Meiler as Head of Sales & Marketing. Ms Meiler joins Pureprofile from London-headquartered market research firm Mintel where she spent more than five years, including three years as country manager for Australasia and New Zealand. EBITDA improvement will also be complemented by the full impact of cost reductions occurring in Q1 FY20, primarily relating to personnel changes, which is expected to be recognised in Q3 and beyond. These cost savings are expected to increase EBITDA by $0.23m per quarter.

Appendix 4C

Operating cash outflow was ($1.1m) as the Lucerne senior debt facility was drawn down to reduce payables owed to suppliers of the same amount. The Company expects a further operating cash outflow in Q2 as the Company continues to reduce supplier liabilities. Pureprofile aims to return to positive operating cash flow in H2 FY20. The Lucerne debt facility was also drawn down to reduce the debtor financing facility from $2m to $1.1m at the end of Q1 and, as at the time of this announcement, the debtor financing facility has been settled and closed.

Annual General Meeting

The Company will hold its Annual General Meeting at 10:00am on Thursday, 28 November 2019 at Level 5, 126 Phillip Street, Sydney NSW 2000.

– ENDS –