By: Andy Averill, Head of Data & Insights (US), Pureprofile

Streaming habits in the US have shifted dramatically in just three years. What was once the future of TV is now the everyday reality. Pureprofile’s latest research reveals that 43% of American adults now say they mainly watch streaming services rather than cable or traditional TV. The shift is even sharper among younger generations – 53% of Millennials (ages 29-44) and 50% of Gen Z (ages 18-28) report streaming as their primary way to watch TV/video. The study surveyed a nationally representative sample of 500 US adults by age and gender. The study was conducted on Datarubico Insights Creator, surveying a nationally representative sample of 500 US adults by age and gender.

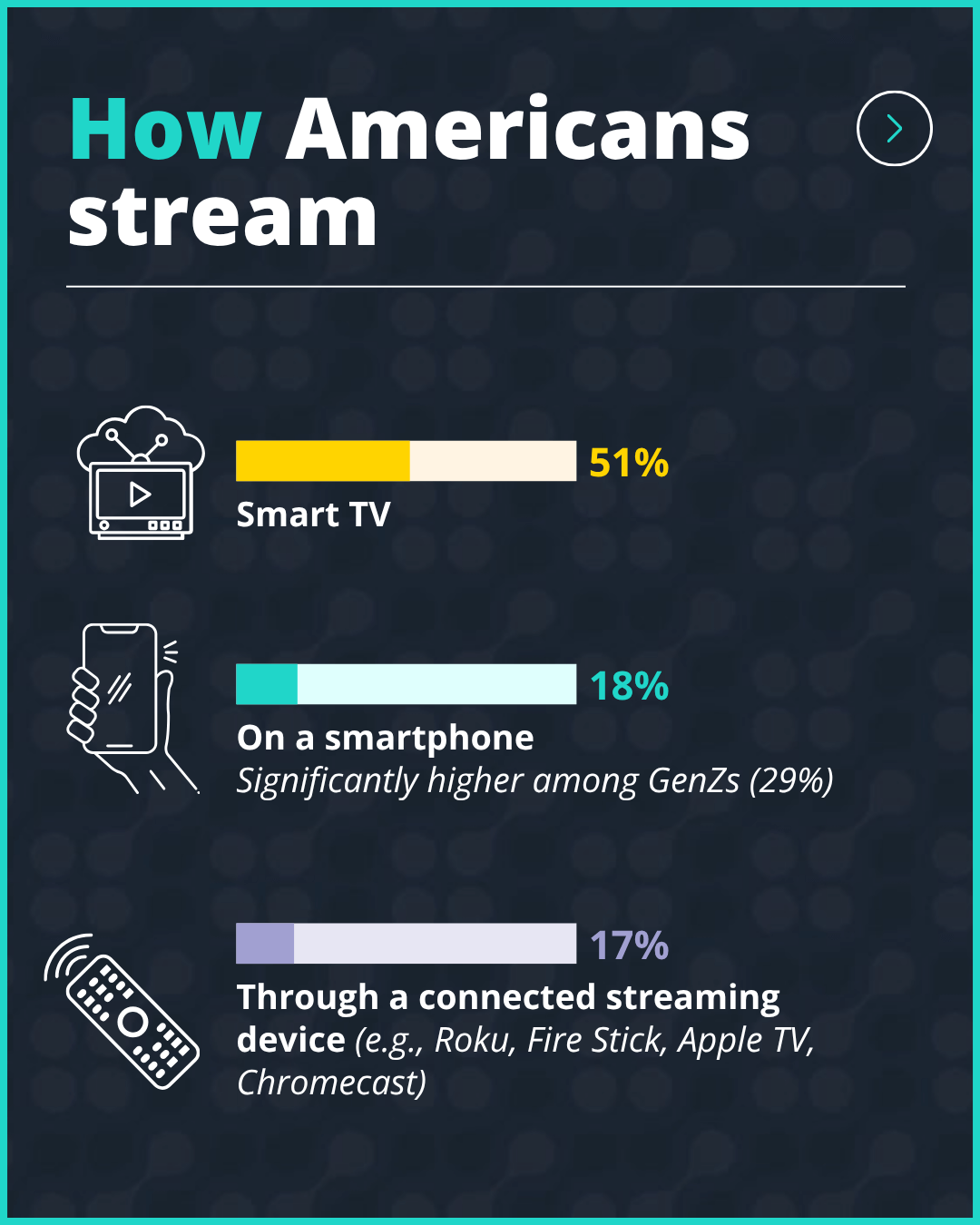

Equally telling is how Americans stream. Among those surveyed, half (51%) tune in via smart TVs, while nearly one in five (18%) watch on smartphones – a figure that climbs to 29% among Gen Zs. Another 17% rely on connected devices such as Roku, Fire Stick, or Apple TV. Alongside device preferences, content formats are shifting too – 23% of Gen Z say they mostly consume short-form video on platforms like TikTok, YouTube, and Instagram Reels, compared with a national average of just 13%. This reflects not only platform preference but also a viewing culture increasingly defined by mobility, choice, and bite-sized entertainment:

The ad-supported side of streaming is also bearing more weight: in Q2 2025, ad-supported content accounted for 74% of all TV viewing, with streaming emerging as the dominant contributor. This highlights a clear trade-off: viewers don’t mind watching commercials if it keeps monthly bills down, and platforms are racing to redesign their models around that reality.

The data also points towards what analysts call the rise of ‘media multitasking’. Smartphones often double as a second screen – used for messaging, browsing, or even parallel streaming. It’s a sign of modern multitasking culture, entertainment in America is no longer bound by time or place. It’s portable, constant, and increasingly personal

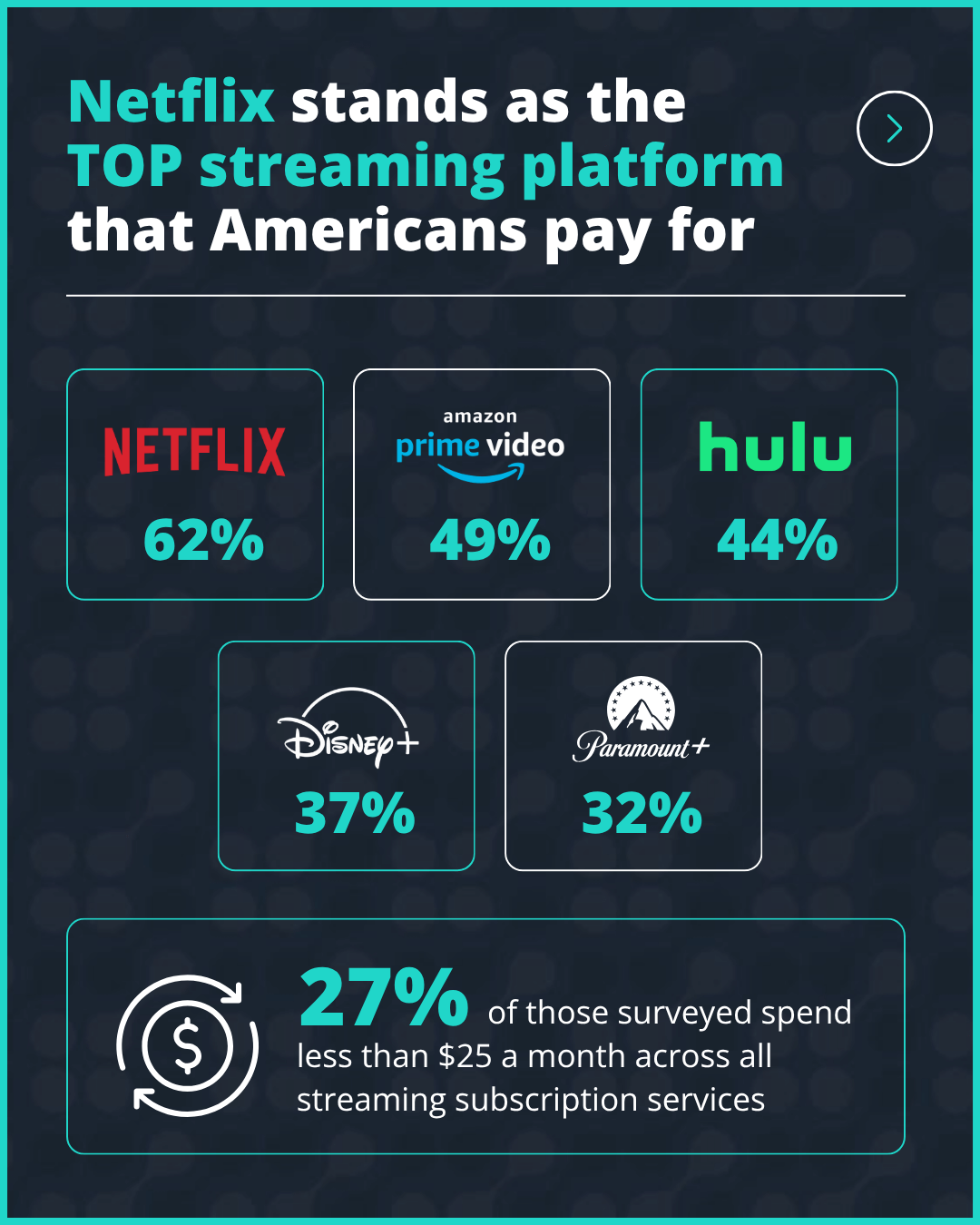

Netflix stands as the top streaming platform that Americans pay for

Netflix continues to dominate the paid streaming market, with 62% of US adults subscribing – well ahead of Amazon Prime (49%), Hulu (44%), Disney+ (37%), and Paramount+ (32%). Yet consumers are careful with their wallets: more than 1 in 4 (27%) spend less than $25 a month across all streaming subscription services. But even Netflix isn’t immune to a restless audience. As ‘subscription fatigue’ grows, long-term loyalty fades. Households increasingly rotate services, keeping only those with the must-watch show of the moment and dropping the rest until the next big release.

When asked if they could keep only one streaming service, respondents named Netflix, Amazon Prime, and Hulu as the ‘can’t-live-without’ options – proof that exclusive programming and original hits remain a strong currency in streaming loyalty.

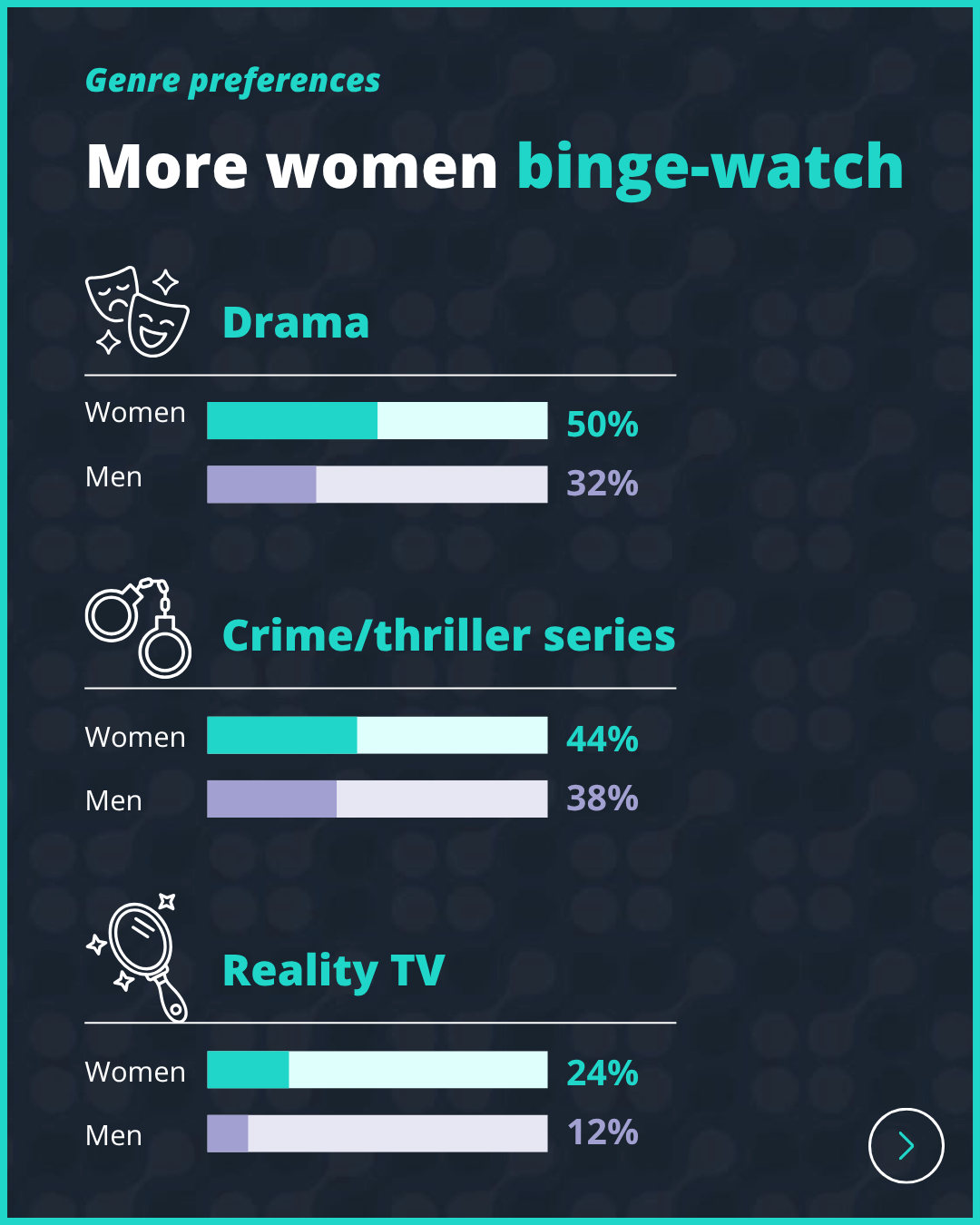

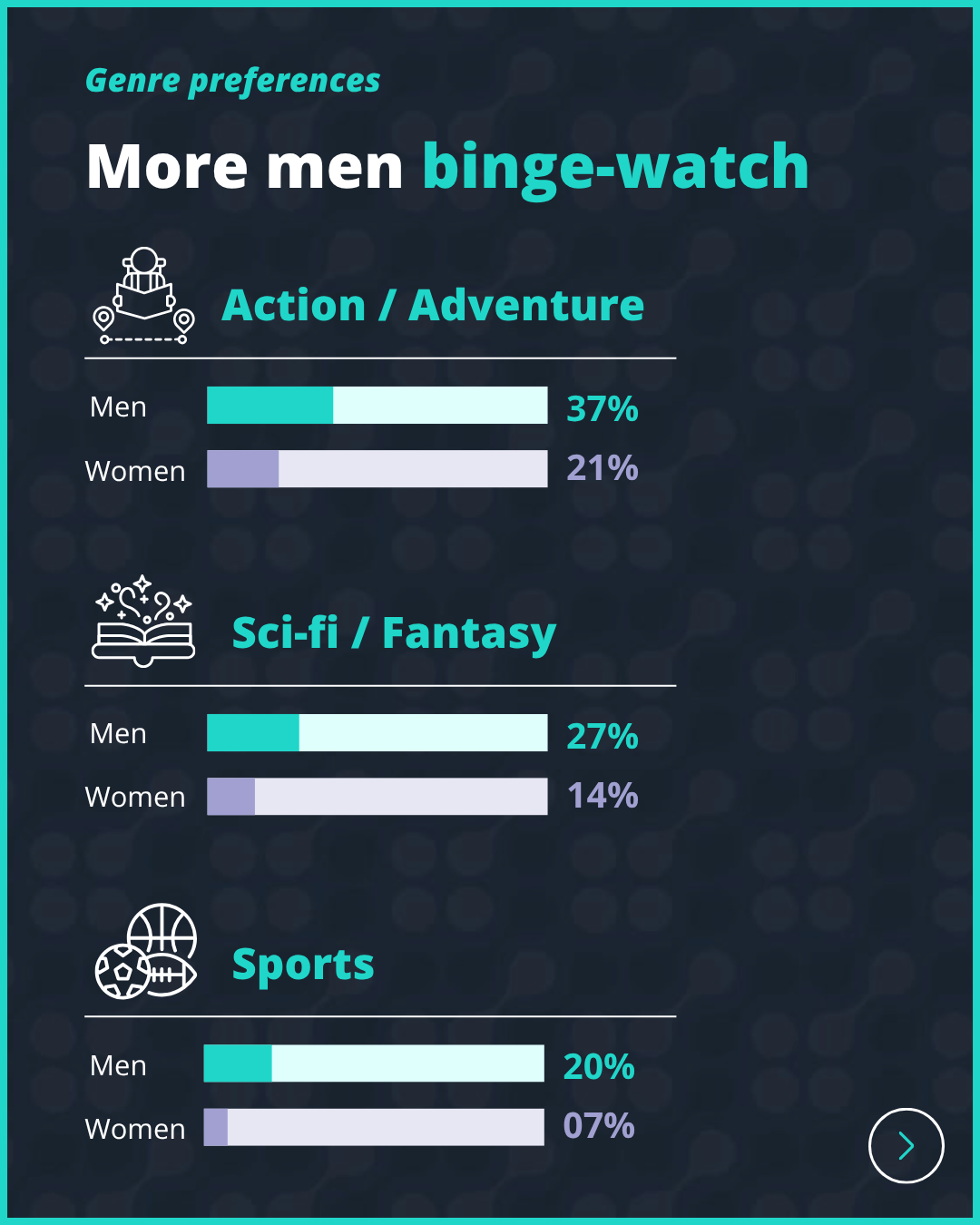

America’s binge-watching favorites

- Women lean toward intrigue and emotion – Drama (50% vs. 32% men), Crime/Thriller (44% vs. 38%), Reality TV (24% vs. 12%).

- Men favor adrenaline and escapism – Action/Adventure (37% vs. 21%), Sci-Fi/Fantasy (27% vs. 14%), Sports (20% vs. 7%).

Why America streams

- Relaxing/unwinding (41%)

- Main form of entertainment (30%)

- Daily routine staple (25%)

- Replacing cable/TV (21%)

- Spending time with family/friends (20%)

- Escaping into stories (19%)

Strategy over scale

The future of streaming will be shaped less by scale and more by strategy. Consumers are selective with their dollars, making exclusivity and clear value the true levers of loyalty. With preferences splintering by genre, gender, and generation, media brands can’t rely on a one-size-fits-all playbook. The golden age of streaming isn’t just about who has the biggest library, it’s about who can stay one step ahead of an audience that expects everything, everywhere, all at once.

Streaming platforms must diversify content and pricing while addressing subscription fatigue through flexibility. And as ad-supported models gain ground, the challenge will be to balance affordability with experience. In short, success belongs to the brands that evolve as quickly as their audiences do.

The infographic below represents key findings from our research:

Based on a nationally representative study of 500 US adults, conducted on Datarubico – Pureprofile’s all-in-one research platform, in September 2025.

Share this infographic on your website

Andy Averill

Head of D&I US

Andy Averill is the Head of Data and Insights for Pureprofile’s US region, bringing 12 years of experience in market research, data strategy, and business development across North America.

Since joining Pureprofile in 2019, Andy has been a driving force behind the company’s US expansion – building strong client partnerships, leading commercial growth, and delivering record-breaking results.

Andy’s extensive background across data and insights has enabled him to lead high-performing teams, develop client-centric strategies, and deliver innovative solutions that drive measurable growth for brands across the US.