Key points

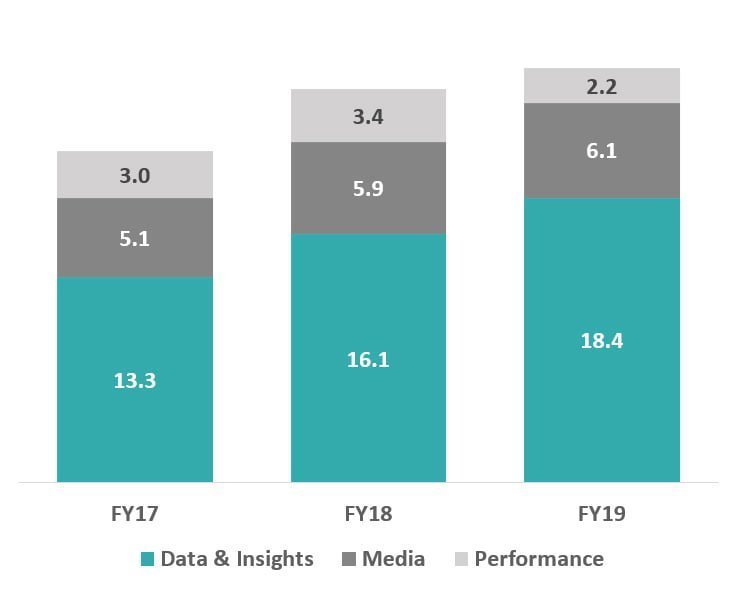

- Strong growth in core Data & Insights business – revenue up 14% (on pcp) to $18.4m

- Media business growing steadily – revenue up 3% (on pcp) to $6.1m

- Strategy to simplify the business and focus on core growth units progressing well – Media Trading business was sold in October 2018 and the Performance ANZ business was sold in March 2019

- FY2019 revenue (incl. discontinued businesses): $38.4m (FY2018: $52.4m)

- FY2019 EBITDA (incl. discontinued businesses): ($0.5m) (FY2018: $0.7m)

- Additional debt of $3m raised in February 2019 with existing lender, along with a $2.6m bridging short-term loan in June 2019 as Company moves to new debtor financing provider

- Capital restructuring initiatives being considered to reduce debt exposure

Pureprofile Limited (ASX: PPL or the Company) provides an update to its FY2019 results (unaudited) ahead of the release of its Appendix 4E and full-year results.

Following the reduction to the Company’s cost base in FY2018, further restructuring initiatives were undertaken in FY2019. The Media Trading business was sold in October 2018 via a share buy-back and in March 2019, the sale of the Performance ANZ business was completed.

The sale of these businesses simplifies the Company’s offering, reduces the Company’s cost base and ensures a focus on its core strengths in Data & Insights and Media. Both these divisions continued to show growth.

| Profit & Loss $A million | |||

| Continuing businesses |

FY18 |

FY19 |

Growth |

| Data & Insights |

$16.1m |

$18.4m |

14% |

| Media |

$5.9m |

$6.1m |

3% |

| Performance |

$3.4m |

$2.2m |

(35%) |

| Other revenue |

– |

$0.6m |

– |

| Total revenue |

$25.4m |

$27.3m |

7% |

| Gross profit |

$15.0m |

$16.1m |

7% |

| GM% |

59% |

59% |

– |

| Other costs |

($17.5m) |

($16.8m) |

4% |

| EBITDA (continuing businesses) |

($2.5m) |

($0.7m) |

72% |

| Discontinued businesses | |||

| Revenue |

$27.0m |

$11.1m |

(58%) |

| Gross profit |

$9.2m |

$3.1m |

(66%) |

| GM% |

35% |

29% |

(6%) |

| Other costs |

($6.0m) |

($3.0m) |

50% |

| Actual EBITDA |

$0.7m |

($0.6m) |

(162%) |

-

The discontinued businesses comprise the Media Trading business (which was sold in October 2018) and the Performance ANZ business (which was sold in March 2019).

-

In the UK, the Data & Insights business unit performed strongly (with growth of 10%), however the Performance business unit declined YoY due to an unforeseen reduction in sales resourcing and capability.

- ‘Other revenue’ includes proceeds from the sale of the Media Trading and Performance ANZ businesses.

- The total EBITDA contribution for the discontinued businesses was $0.1m. Had the businesses continued, it is expected to have contributed negative EBITDA.

Breaking the results down on a half-year on half-year basis:

| Profit & Loss $A million | |||

| Period ending 30 June |

H2FY18 |

H2FY19 |

Growth |

| Data & Insights |

$7.9m |

$9.0m |

14% |

| Media |

$2.6m |

$3.2m |

23% |

| Performance |

$1.6m |

$0.8m |

(50%) |

| Other revenue |

– |

$0.3m |

– |

| Total revenue |

$12.1m |

$13.3m |

10% |

| Gross profit |

$7.6m |

$8.0m |

5% |

| GM% |

63% |

60% |

(3%) |

Whilst the retained Performance business in the UK continued to lag, the focus on the remaining core growth areas of the business has generally been successful. This is validated on a year on year basis:

During the year, the Company increased its debt facility with the existing lender by $3m. A further bridging loan of $2.6m has been provided to support the Company as it transitions to a new debtor financing provider. Total debt as at 30 June 2019 was $16.5m.To address the high-level of debt and put Pureprofile on a stronger financial footing, the Company is exploring capital restructuring initiatives and other strategic options.

CEO commentary

Pureprofile CEO, Nic Jones, said: ‘This has been a challenging year but we are happy with the performance and growth of our core business units. Having sold the non-performing businesses Pureprofile is a much stronger company.

We are confident in the continuing success of our turnaround and look forward to the year ahead.’

The Company’s Appendix 4E and full-year results, along with FY2020 guidance, are expected to be released towards the end of August 2019.

– ENDS –