By: Tyrone S’ng, Data and Solutions Lead

The Autumn Budget sets the stage for how the Labour government intends to lead the country, and voters are assessing not just the numbers, but the direction of travel. For many, it is an indicator of whether the promises made at the election are turning into credible action. Our latest UK study, based on 1,002 respondents and nationally representative of the UK population by age, gender and country, explores public reaction to the 2025 Budget, perceptions of Labour’s performance since winning the election, and what current voting sentiment suggests about the political landscape. Taken together, the findings show a public that is paying close attention, but increasingly unsure whether delivery will match ambition.

Budget reaction: a split verdict on fairness and impact

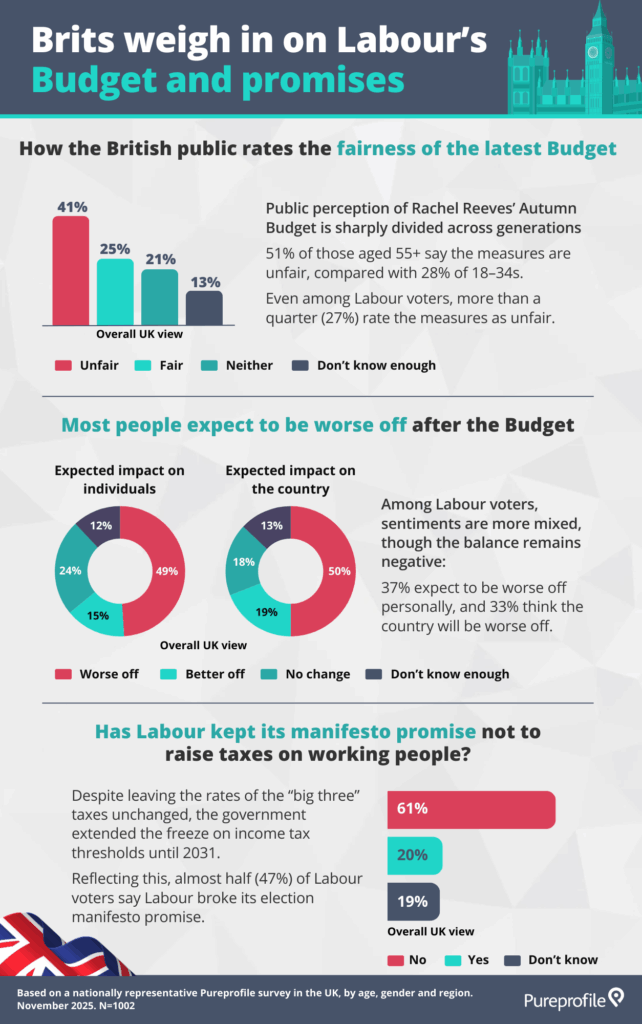

The 2025 Budget has clearly cut through. Nearly three quarters of Brits say they followed it very or fairly closely. When asked whether the Budget feels fair, 41% of people in the UK said the Budget was unfair compared with 25% who felt it was fair. Age is one of the sharpest dividing lines. Brits aged 55 and over are far more likely to describe the Budget as very unfair (26%), compared with those aged 35–54 (20%) and 18–34 year olds (9%).

In contrast, younger adults show the opposite pattern. Those aged 18-34 are much more likely to rate the Budget as fair (29%) compared with 35–54 year olds (21%) and those aged 55+ (14%). The same applies to ratings of very fair with 18–34 year olds (8%) compared with ages 35–54 (4%) and ages 55+ (1%). In short, older Brits are more likely to view the Budget through a fairness deficit, while younger adults are more inclined to give it a positive read.

Looking ahead, many voters believe the Budget will leave them and the country worse off. 49% of Brits expect their household to be worse off, compared with 15% who expect to be better off. This is another area where the generational gap opens up. Over 55 year olds are far more likely to anticipate being slightly worse off (42%) compared with those aged 35–54 (34%) and 18–34 year olds (21%). They are also more likely to feel they will be much worse off, with those aged 55+ (19%) compared with ages 35–54 (16%) and ages 18–34 (11%). Meanwhile, 24% of 18–34s are substantially more likely to expect they will be slightly better off, compared with 10% of 35–54 year olds and 3% of those aged 55 and over.

At a national level, the mood remains cautious. Half of of the British public believe the country will be worse off and fewer than one in five expect improvement (19%).

Perceptions of trust are also being shaped by the way voters interpret what counts as a tax rise. Even without changes to headline rates, the continuation of the income tax threshold freeze appears to be landing as a breach of Labour’s promise: 61% of Brits say Labour has broken its promise not to raise taxes on working people. Age differences are pronounced. 32% of those aged 18–34s say Labour has kept its commitment, falling to 18% among 35–54 year olds and 12% among over 55s. Conversely, belief that Labour has broken its promise rises steadily with age (18–34: 45%, 35–54: 62% and 55+: 72%).

Labour’s performance: increasing scepticism on key missions

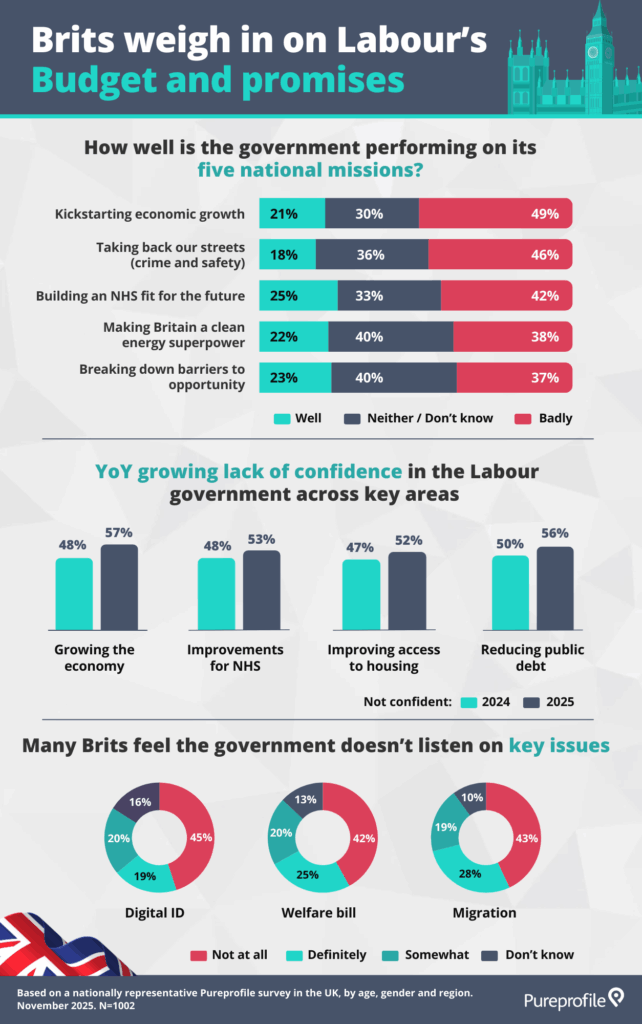

Beyond the Budget, we asked how the public feels Labour is performing against its stated national missions. Across each one, negative sentiment outweighs positive. The figures below show the proportion who believe the government is performing badly in each area:

- Economic growth (49%)

- Crime and safety (46%)

- NHS (42%)

- Clean energy (38%)

- Breaking down barriers to opportunity (37%)

Again, age sharpens the story. On Labour’s ability to kickstart economic growth, the proportion saying the government is doing very badly rises sharply with age: 55+ (37%), ages 35–54 (22%) and ages 18–34 (12%). A similar pattern appears for crime and safety, with very badly ratings highest among those aged 55+ (33%) compared with ages 35–54 (23%) and 18–34s (14%). Together, these differences point to a tougher performance scorecard among older respondents.

Confidence measures reinforce the picture of an electorate waiting to be convinced. 57% of Brits are not confident Labour can grow the economy. Similar concerns apply to its ability to reduce NHS waiting times and improve service quality (53%), improve access to housing (52%), or reduce public debt (56%). Crucially, this scepticism has intensified year on year. Compared with 2024, the share who are not confident has increased across all four outcomes: +9pp on growing the economy (48% in 2024), +5pp on the NHS (48%), +5pp on housing access (47%), and +6pp on reducing public debt (50%).

And the age gradient is stark. For growing the economy alone, not confident levels rise from 39% among 18–34 year olds, to 56% among those aged 35–54, and to 73% among over 55s. This same shape appears across NHS improvement, housing access and reducing public debt, indicating that scepticism is concentrated heavily among older cohorts.

Shifting voting patterns: Labour loses ground as Reform UK advances

On specific issues, the ‘listening gap’ is another clear theme. Overall, 43% of Brits say the government is not listening at all on key issues. Age again plays a defining role: not at all ratings sit at 26% among 18–34 year olds, rise to 45% among ages 35–54, and reach 55% among over 55s. This pattern is consistent across issue cuts such as digital ID, the welfare bill and migration.

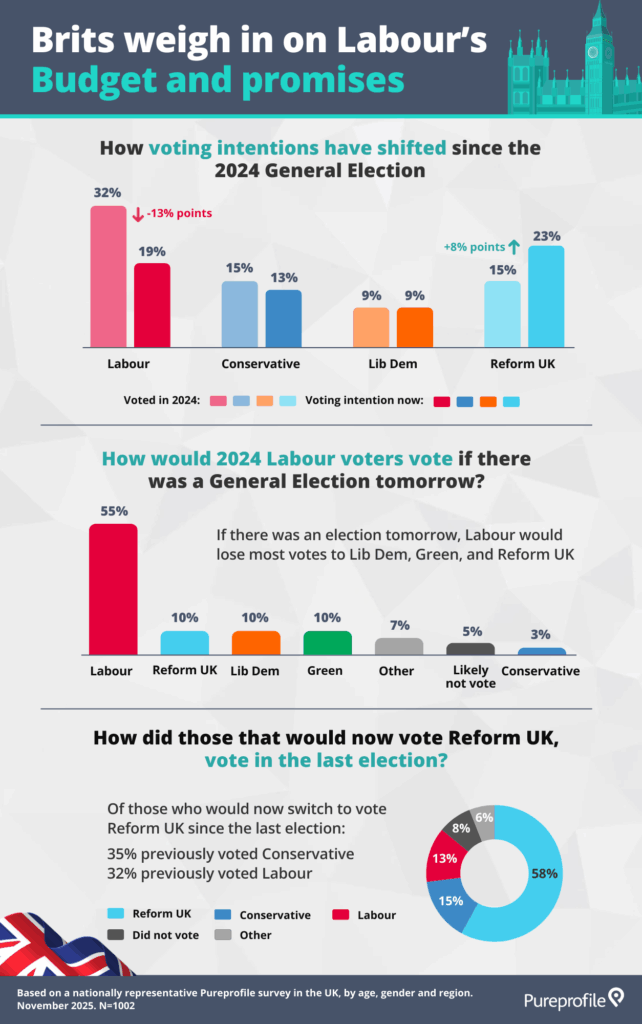

When we compare how people voted in the 2024 General Election with how they say they would vote now, clear shifts begin to emerge. Labour’s reported 2024 share in this sample is 32%, yet if an election were held tomorrow it drops to 19%. By contrast, Reform UK rises from 15% in 2024 to 23% now. This aligns with the story emerging from our research: voters are not simply disengaging, they are re-evaluating, and political loyalty is increasingly open to change.

What public opinion reveals about UK’s political landscape

Across the three parts of this research, there is a clear mood of growing caution and rising expectation. Views on the Autumn Budget show marked divides across age groups, particularly around fairness and personal impact. Confidence in the Labour government’s core missions remains fragile, with older voters consistently the most sceptical across economic growth, the NHS, housing and public debt.

Shifts in voting intention reinforce this picture. The movement is not towards disengagement, but towards reconsideration, with Reform UK attracting support from both former Labour and Conservative voters. This suggests a political landscape where loyalty is increasingly open to change and where performance, not promises, is shaping sentiment.

The infographic series below represents key findings from our research:

Based on a nationally representative Pureprofile survey of 1,002 people in the UK, November 2025.

Share this infographic on your website

Tyrone S’ng

Data and Solutions Lead

With experience spanning Southeast Asia and the United Kingdom, Tyrone brings a global perspective to his role as Data and Solutions Lead. Tyrone serves as a trusted advisor for the Data & Insights team, translating complex client needs into actionable, data-driven solutions and supporting internal teams to ensure optimal project delivery.

In addition to his professional practice, Tyrone served as an Adjunct Lecturer at Temasek Polytechnic, where he taught Research Methods for the Specialist Diploma in Applied Psychology (Behavioural Insights). This dual engagement in both academia and industry positions him to bridge rigorous research standards with practical, client-focused insights.