By: Joris Schellekens, Head of Data & Insights – Mainland Europe

Saving money has become a growing priority for households across Europe, as many respond to prolonged inflation and economic challenges by adjusting how they spend, save, and plan for the future. While the economic outlook is gradually stabilising, many people remain cautious, focusing on practical strategies to help them stay in control and build financial resilience.

To understand how individuals are adapting their spending habits, rethinking financial priorities, and making decisions about money management, Pureprofile surveyed 600 consumers across Spain and the Netherlands. The aim was to gain insight into current attitudes around personal finance and saving, uncover differences between countries, and highlight how people are reshaping their approach to financial wellbeing.

Our findings reveal a four-part story: from taking back control, to maintaining financial discipline, developing a long-term money mindset, and setting priorities for a more financially secure future.

1. Building financial control through budgeting

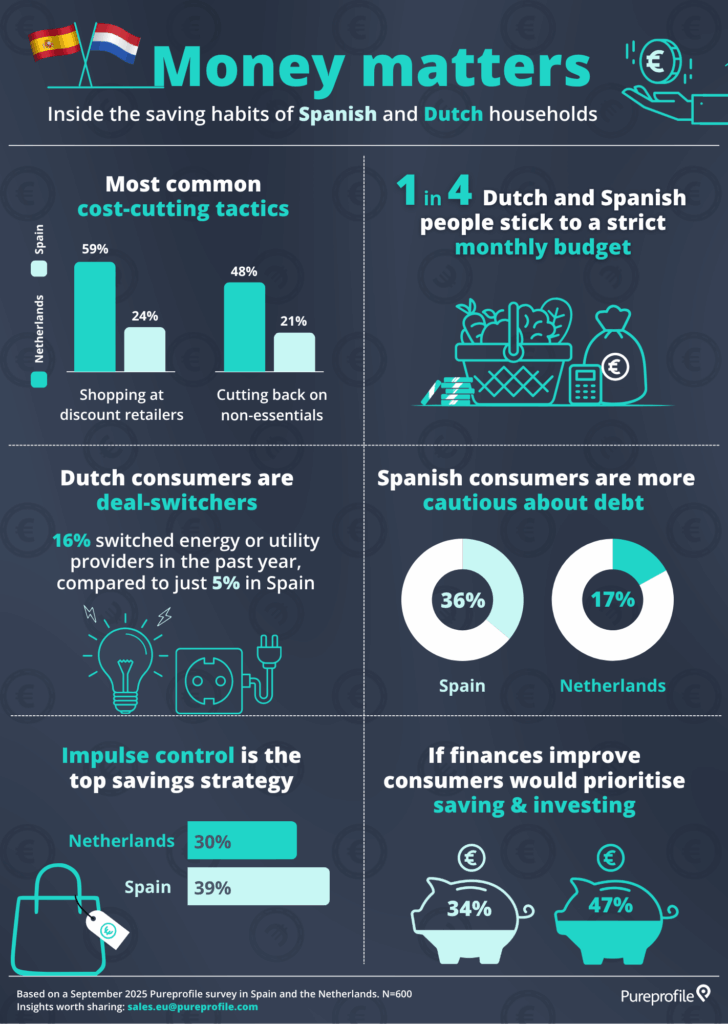

For many, managing household finances begins with getting a handle on day-to-day spending. In both Spain and the Netherlands, 1 in 4 respondents said they stick to a strict monthly budget, a clear sign that people are seeking structure and predictability to maintain financial stability.

48% of consumers in the Netherlands are cutting back on non-essential spending such as dining out or entertainment, compared to 21% in Spain. This suggests Dutch consumers may be taking a more proactive or deliberate approach to reducing non-essential spending, while Spanish households may be responding more gradually to shifts in their financial situation.

Whether through budgeting apps, weekly spending limits, or simple money management techniques, people are taking steps to stay in control of their finances and feel more secure in the face of ongoing economic pressure.

2. Money-saving habits and smarter spending

Consumers in both countries are using practical cost-saving tactics to keep everyday expenses down and make their money go further – changing where, how, and when they spend.

- In the Netherlands, 59% shopped at discount retailers such as Aldi and Lidl in the past year, and 34% bought items in bulk or during promotions, reflecting a strong emphasis on value-driven purchasing

- In Spain, 24% shopped at discount retailers and 10%, took advantage of promotions and bulk buys, a notably less common cost-saving approach between the two countries

Loyalty schemes, cashback offers, and rewards are also popular. These were used by 25% of Dutch respondents and 12% of Spaniards. These strategies reflect a broader shift towards smarter spending and stretching the value of money, particularly in the Netherlands.

3. A shift in money mindset and priorities

More than short-term fixes, the findings point to a shift in mindset, especially among Spanish consumers. When asked about their main savings strategy, the top response was ‘avoiding impulse purchases’, answered by 39% of consumers in Spain and 30% in the Netherlands. This signals growing self-awareness and restraint, especially around emotional or impulsive buying, a key step in saving and regaining control.

The shift is even more apparent when looking at long-term attitudes towards money:

- 42% of Spanish respondents and 37% of Dutch respondents said they now focus more on saving money and budgeting

- 36% in Spain also said they are more cautious about debt, compared to just 17% in the Netherlands

Switching providers is another example. In the past year, 16% of Dutch respondents changed energy or utility providers, compared to just 5% in Spain. These differences may reflect a greater willingness among Dutch consumers to shop around for better deals, while Spanish households appear to take a more measured, cautious, and risk-averse approach.

While both groups demonstrate money-conscious behaviour, Spanish households are experiencing a deeper mindset shift, possibly influenced by greater perceived financial vulnerability or uncertainty.

4. Financial planning for the future

Today’s economic pressures haven’t just changed day-to-day spending, they’re reshaping how people think about money in the longer term. When asked where they’d prioritise spending if their financial situation improved, the top answer in both countries was saving or investing for the future, selected by 47% in the Netherlands and 34% in Spain.

Travel and holidays was the second most popular choice, particularly in the Netherlands (45%) compared to Spain (22%). By contrast, fewer than 1 in 10 respondents in either country would spend more on entertainment, tech, or lifestyle purchases, further underlining the cautious, forward-looking mindset. Showing that while the desire for leisure remains, the focus is firmly on financial resilience and life experiences.

While it’s encouraging that more people report improved finances than worsened over the past year, the broader picture is one of careful spending, practical cost-cutting, and long-term planning.

Spanish and Dutch consumers are making intentional choices and practising smart money management to support their financial wellbeing. Dutch consumers lean more heavily on cost-saving tactics like bulk buying and deal-hunting, while Spanish households place stronger emphasis on budgeting and debt avoidance, showing strong financial awareness.

What emerges is a shared shift focused on intentional spending and saving money wisely. These results highlight the practical trade-offs consumers are making to stay financially healthy and how they’re actively reshaping what financial stability means in today’s world.

The infographic below represents key findings from our research:

Based on a Pureprofile survey of 600 people in Spain and the Netherlands, September 2025.

Share this infographic on your website

Joris Schellekens

Head of Data & Insights – Mainland Europe

Joris is Pureprofile’s Head of Data & Insights for Mainland Europe, and has been in the market research world for nearly 2 decades. He has enjoyed a number of promotions during his career and has established Pureprofile’s fast growing European business since joining the company in 2021.

Having held various roles in leading international panel and research companies, Joris is highly experienced and passionate about the industry. He enjoys sharing his knowledge to advise and guide his clients on how insights can be best used to reach their business goals. Joris is hugely proud of the strong client relationships he has forged over many years, his collaborative approach has delivered much long-term success to both Pureprofile and his partners.