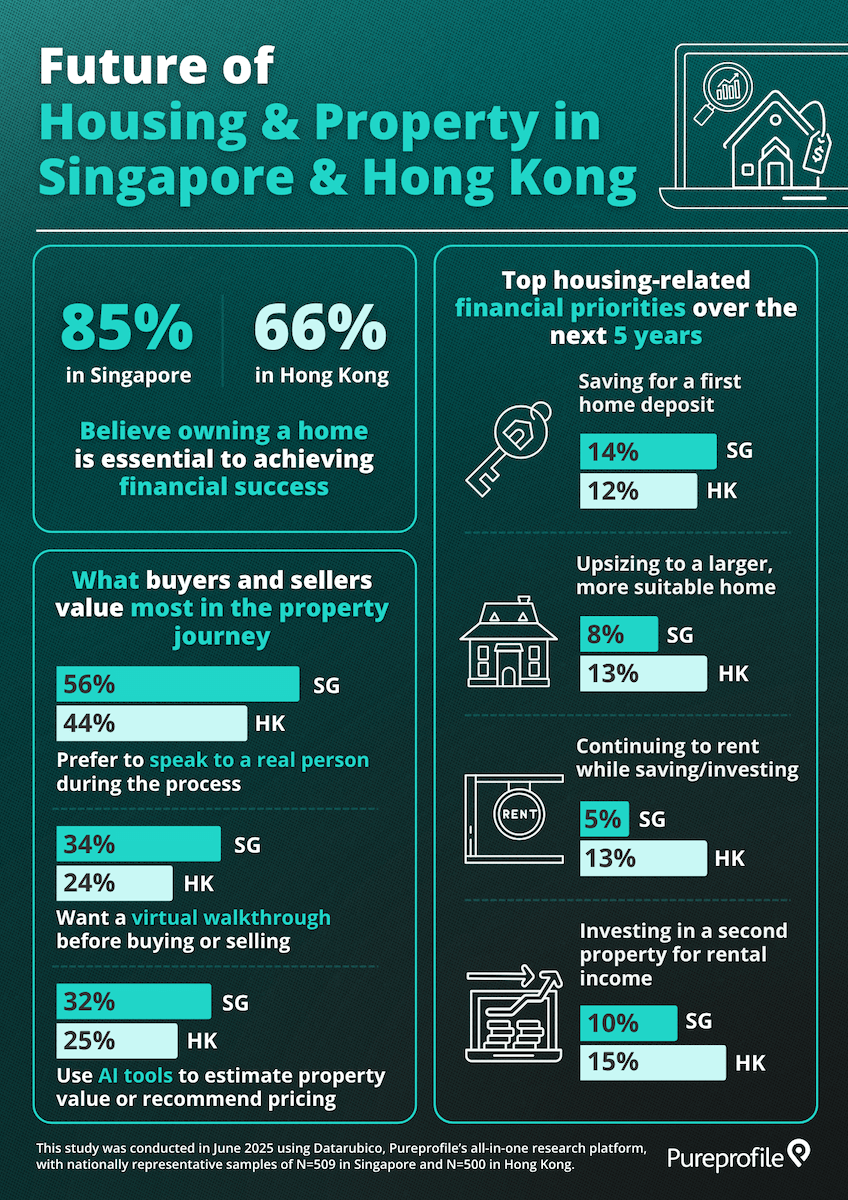

Across Singapore and Hong Kong, owning a home remains a powerful marker of financial success, with 85% of Singaporeans and 66% of Hong Kong residents considering it essential.

Through Pureprofile’s all-in-one research platform, Datarubico Insight Creator, we set out to understand how people in these two competitive markets are thinking about their housing futures: their financial priorities, what they value most in the property journey, and how technology is shaping their decisions.

Surveying 509 adults in Singapore and 500 in Hong Kong, we found a strong preference for personal interaction when buying or selling (56% in Singapore and 44% in Hong Kong). At the same time, there is growing interest in virtual walkthroughs (34% and 24%), as well as in AI tools that help estimate property values or recommend pricing (32% and 25%).

Looking ahead, their top goals include saving for a first home, upsizing to a more suitable property, continuing to rent while saving or investing, and, for some, purchasing a second property as an investment.

These findings paint a clear picture of how expectations and behaviours are evolving across two of Asia’s most dynamic housing markets.

The infographic below represents key findings from our research:

Based on a nationally representative study of N=509 in Singapore and N=500 in Hong Kong, conducted on Datarubico – Pureprofile’s all-in-one research platform, June 2025.

Interested in how this compares to the UK? Read our insights on the Future of housing and property in the UK here >

Share this infographic on your website