By: Andy Averill, Head of Data & Insights US

Thanksgiving and Black Friday shopping trends are once again shaping how Americans prepare for the holiday period, as consumers balance long-standing traditions with a growing focus on value. With Black Friday now firmly embedded as a major shopping event that sits alongside Thanksgiving, many people are planning their purchases around the long weekend, using the occasion to make the most of deals, pick up gifts, and stock up on seasonal essentials. This blend of tradition and well-timed shopping continues to influence how consumers plan and how they choose to participate.

To build a clearer picture of how these behaviours are playing out this year, we wanted to explore the attitudes behind both the celebrations and the shopping activity. Drawing on a nationally representative survey of 500 US adults, our research outlines key patterns, purchase priorities and the types of offers and incentives shaping their shopping intentions.

Thanksgiving traditions remain strong

Celebration is still at the heart of the holiday season:

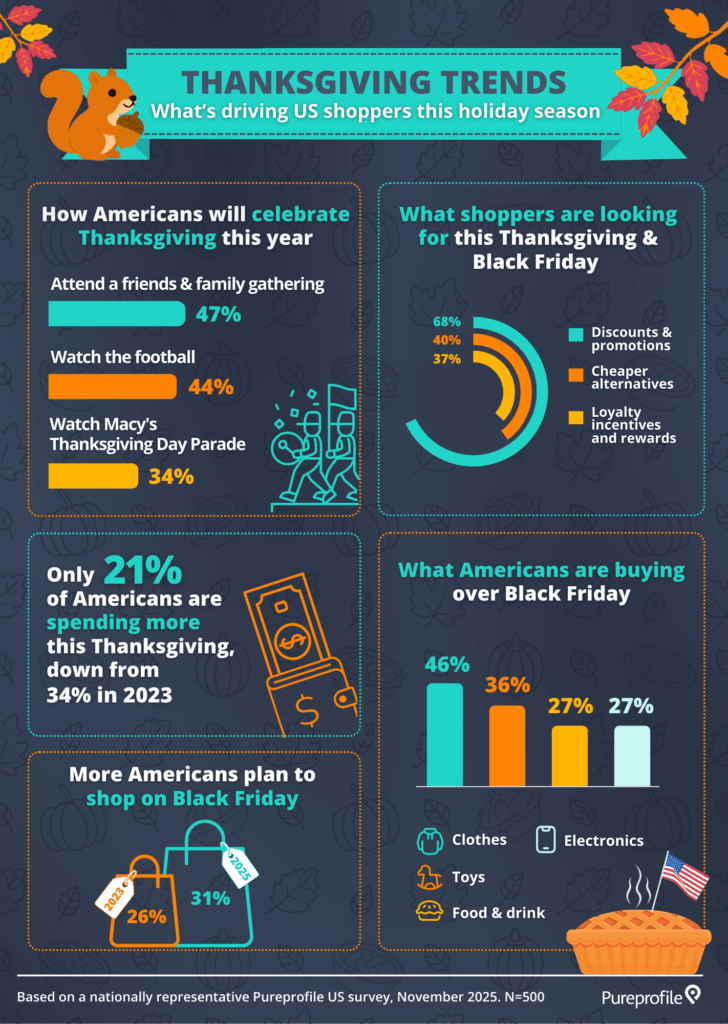

- 47% of Americans say they will attend a friends-and-family gathering this year

- 44% plan to watch the football

- 34% expect to watch the Macy’s Thanksgiving Day Parade

These habits echo earlier popular trends. In 2023, 49% said they would attend a friend’s or family member’s gathering, 25% planned to watch the football, and 22% expected to watch the Macy’s Thanksgiving Day Parade. Despite slight shifts in how people spend the day, the core sentiment remains steady: Thanksgiving is a time to connect, unwind and enjoy shared traditions

Shifts in holiday spending habits

Although more people plan to shop Black Friday this year, many Americans remain measured in how they approach their spending. Only 21% say they will spend more this Thanksgiving, down sharply from 34% two years ago. This shift indicates a more considered approach to Thanksgiving spending compared with the findings from 2023.

Despite this caution, interest in Black Friday remains strong. Consumers are becoming more strategic, prioritising relevant offers and making more intentional choices about when and where they spend. Americans remain engaged in the season, just with greater awareness of cost and value.

Black Friday gains momentum in 2025

One of the most notable shifts is the rise in Black Friday participation. In 2023, 26% of consumers planned to shop the event, this has risen to 31% of Americans plan to shop on Black Friday in 2025. This uptick is significant given the broader economic climate, firmly positioning Black Friday as a key moment for consumers looking to maximise value.

The items topping shopping lists this year show clear priorities:

- Clothes 46%

- Electronics 36%

- Toys 27%

- Food and drink 27%

These align closely with 2023 patterns, where clothes (40%), electronics (34%), and food and drink (32%) were also leading categories. The consistency suggests that Black Friday continues to serve two major purposes for shoppers: practical purchasing, such as household or seasonal needs; and gift-focused buying, as consumers prepare for the winter holidays.

Value-driven decisions shaping holiday shopping

In 2025, the number-one driver for Thanksgiving and Black Friday shopping is clear: value leads the way. When asked what they are looking for this season, 68% of Americans say they are looking for discounts and promotions, followed by 40% who want cheaper alternatives and 37% who value loyalty incentives or rewards.

American consumers are not only seeking deals, they are proactively comparing options, trading down where needed and rewarding brands that recognise their loyalty. Shoppers are open to:

- Switching to lower-cost brands

- Choosing value-focused retailers

- Using loyalty points and rewards to offset expense

Deal-driven shopping continues to influence how consumers make their holiday purchasing decisions.

With more consumers planning to shop Black Friday, but fewer willing to increase their spending, the competition for attention will intensify. Retailers that provide meaningful value through strong price reductions, appealing loyalty incentives, and accessible alternatives will be best positioned to attract cost-conscious shoppers. Our research shows that Thanksgiving and Black Friday work hand in hand, combining celebration with deal-seeking as part of the American holiday experience.

The infographic below represents key findings from our research:

Based on a nationally representative Pureprofile survey of 500 people in the US, November 2025.

Share this infographic on your website

Andy Averill

Head of Data & Insights US

Andy Averill is the Head of Data and Insights for Pureprofile’s US region, bringing 12 years of experience in market research, data strategy, and business development across North America.

Since joining Pureprofile in 2019, Andy has been a driving force behind the company’s US expansion – building strong client partnerships, leading commercial growth, and delivering record-breaking results.

Andy’s extensive background across data and insights has enabled him to lead high-performing teams, develop client-centric strategies, and deliver innovative solutions that drive measurable growth for brands across the US.