By: Emily Beach, Head of Data & Insights UK

As the festive season approaches, Christmas shopping is already front of mind for many people across the UK as they plan how they will celebrate and spend over the coming weeks. New insights from Pureprofile reveal that the country’s approach to Christmas is shaped by financial awareness, thoughtful choices and a desire to make meaningful celebrations without stretching budgets too far. This year’s findings paint a picture of a nation looking for value while still embracing the warmth and anticipation of the holidays.

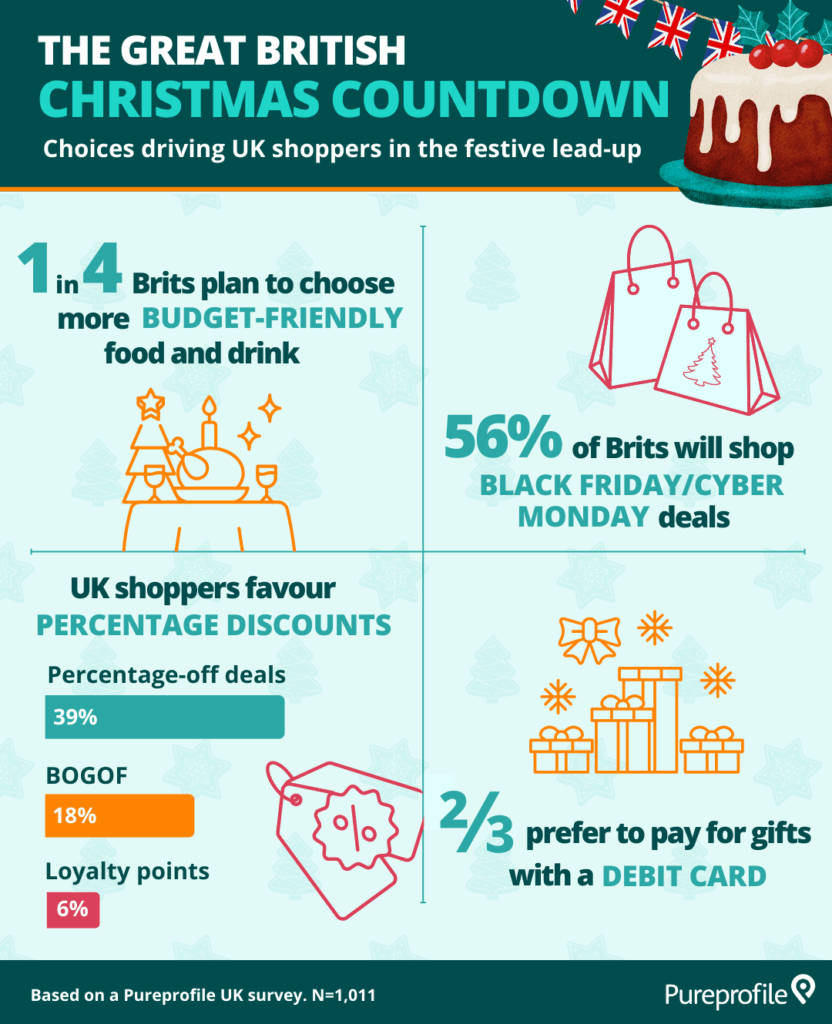

To understand these behaviours in more detail, we surveyed 1,011 consumers across the UK. Here is what we uncovered.

Budget-savvy festive food and drink spending

Food and drink are central to Christmas traditions, but rising household costs mean people are making more considered choices. 1 in 4 UK consumers plan to opt for more budget-friendly festive food and drink. This emphasis on affordability aligns with broader patterns seen in the UK, where financial caution has become a central part of holiday planning.

However, Brits are still willing to prioritise certain festive essentials. 56% of Brits expect to spend more on food and drink this year. Spending on festive food and drink is up for the UK compared to 2024. This suggests that even with more budget-friendly choices, the impact of rising costs means many households still expect to spend more overall. The anticipated increased spend on this category, despite tight budgets, underlines the importance of food and drink in bringing people together at this time of year.

Shopper preferences and the search for value

Christmas shopping continues to shape how people plan their spending in the weeks ahead. When it comes to festive buying habits, finding a good deal remains important. 56% of UK Brits say they will take advantage of Black Friday and Cyber Monday deals, a full 24% pts higher than last year. These events continue to influence early holiday purchasing and gift planning. Deal-seeking behaviour is further reflected in offer preferences. UK shoppers clearly favour straightforward savings:

- 39% prefer percentage-off discounts

- 18% choose buy-one-get-one-free offers

- 6% look for loyalty point offers

Simple, transparent discounts remain the most trusted way for people to feel they are getting good value.

Payment choices also reflect the desire to stay in control. 2 in 3 Brits say they prefer to pay for gifts with a debit card. This leans towards immediate affordability rather than building up balances to repay in the New Year. At a time when financial planning is front of mind for many households, debit card use highlights the growing emphasis on mindful spending.

Gifting and travel plans

Gift spending is also shaping how people plan for the festive season. On average, Brits expect to spend 15% more on gifts this year, showing that some people are still willing to stretch their budgets to make the season feel special. While not everyone is increasing their spend, this group reflects a desire to make meaningful purchases despite wider cost pressures.

Travel plays a relatively small role in how people across the UK plan to celebrate this year. Only 8% of people in the UK expect to spend Christmas abroad, showing that the vast majority will be staying closer to home for their celebrations.

The UK’s festive lead-up is shaped by a mix of financial awareness and festive optimism. People are thinking carefully about how they spend, yet still making room for the traditions and moments that matter most. This year’s insights show how shoppers are adapting to rising costs with confidence and a strong sense of value. As households prepare for the celebrations ahead, Christmas 2025 looks set to be influenced not only by what people buy, but by the considered choices that help them celebrate.

The infographic below represents key findings from our research:

Download our 2025 Global Christmas Report to uncover deeper insights.

Based on a nationally representative Pureprofile survey of 1,011 people in the UK, September 2025.

Share this infographic on your website

Emily Beach

Head of Data & Insights UK

As an experienced leader in market research and data-driven insights, Emily serves as Head of Data & Insights UK at Pureprofile. With almost 20 years’ experience in the research industry, Emily brings deep expertise in online research design and excellence, and insight-driven strategy.

Prior to Pureprofile, Emily held senior commercial and client development roles, delivering high-quality projects for major brands and agencies. Having worked in the UK and US, she has wide-ranging expertise across a range of industry sectors; scoping and delivering global projects including broad segmentation pieces, specialised pricing research, and due diligence research among niche B2B targets to underpin M&A activity.

With this background, Emily helps clients understand their audiences deeply, build data-backed strategies, and make informed decisions grounded in real insights.

A Cambridge University alumna, Emily champions an empathetic and collaborative approach to her team’s work, with deep understanding of stakeholder objectives and strong relationships as paramount in everything she does.